Before the market opens, it’s crucial for traders to check how the market is set to open. This involves looking at whether the market will open with a gap up, gap down, or if it will be balanced.

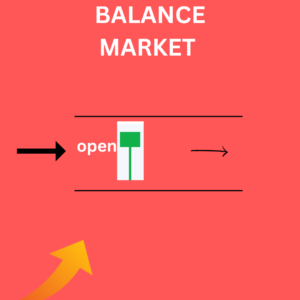

Balanced Market Open

A balanced market open happens when the market opens within the previous day’s trading range (between the previous day’s high and low). In this case, the market might stay range-bound for the day, especially if it opens near the Point of Control (POC), where the market spent most of its time the previous day.

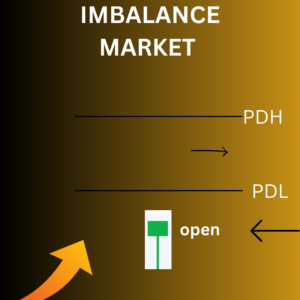

Imbalanced Market Open

An imbalanced market open occurs when the market opens outside of the previous day’s range. This can lead to more significant price moves and is important to watch during the first 15 minutes to understand the market’s direction.

What is a Gap Up Open?

A “gap up open” happens when the price opens higher than it closed the day before. Gaps are important in trading. They can be big or small. Traders need to watch if the market opens outside the previous day’s range or within it.

What is a Gap Down Open?

A “gap down open” occurs when the price opens lower than it closed the day before. I’ll talk more about price action in my next post.

Previous Day High and Low

The previous day’s high and low are very important for traders. They help us understand the market better.

Always follow your trading plan and rules. Not every day is a good day for trading, so stay disciplined and stick to your strategy.